Note: this post was written on December 16th, 2020 and is only valid for within a few days around that date. For the latest updated in January 2021, click here!

Bitcoin has finally hit $20k as of December 2020! Bitcoin’s next clear threshold is $30k. Will Bitcoin hit $30k in 2020, 2021, or beyond that? We use empirical option pricing data to generate a random walk model that gives you hard numerical predictions for when BTC will hit $30k or even $40k.

Which model to use for Bitcoin price movement?

When Bitcoin hits a certain price depends on your model.

The industry gold standard numerical predictions is a random walk model that pulls volatility information from actual trade data. This is the model we use, pulling implied volatility from Deribit.

The random walk model is appropriate even if you’re a Bitcoin bull or bear. You can believe that in the long run, Bitcoin will go up. But if you believe that short-term, fluctuations in Bitcoin price every minute are mostly uncorrelated, then you believe in the random walk model. This model also generates cold hard numbers to inform your investments, versus vague pronunciations of “resistance” or “profit taking”.

When will Bitcoin hit $30,000 in 2021?

Running 1,000,000 ensembles in using our gold standard model, we project that Bitcoin will at least touch $30,000 with 73.1% chance on or before December 31st, 2021.

But 2021 is a long time. When exactly will Bitcoin actually hit $30k?

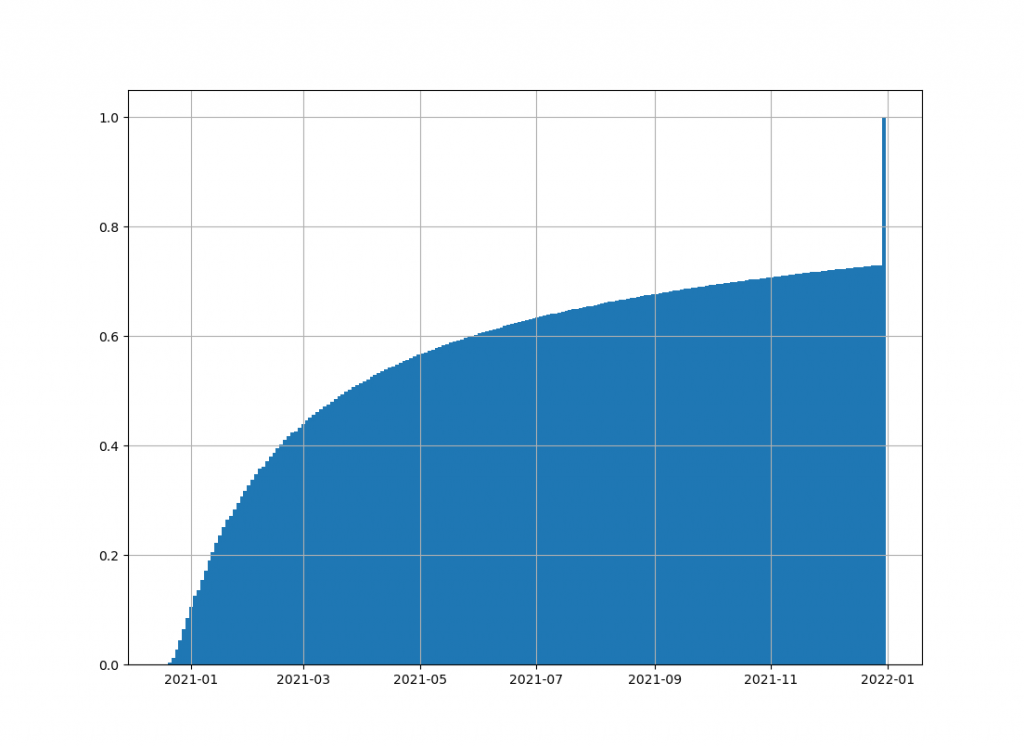

The below chart gives the cumulative distribution of when Bitcoin will hit $30k. To read the chart, first take a date like 2021-07-01 (which lines up to the “2021-07” tick below). Find the date on the x-axis, and then go up to the y-axis, where you get .65. This means that Bitcoin will hit $30k on or before 2021-07 with 65% chance.

You can see that that there is a 70% chance of hitting $30k before November 2021, and a 45% chance of hitting $30k before March 2021.

What the highest price that Bitcoin will hit in 2021?

From our same model, we can calculate the highest price that Bitcoin will ever hit before the end of 2021. We calculate that Bitcoin’s median high price in 2021 will be $38,000, and Bitcoin’s average high price will be $50,500.

Why is the average high price greater than the median high price? Because of positive skew: in the best ensembles from our simulation, Bitcoin’s high price is much higher than average. In fact, there is a 9% chance Bitcoin breaks $100,000 in 2021. 9% is a relatively high chance for hitting $100,000 so soon!

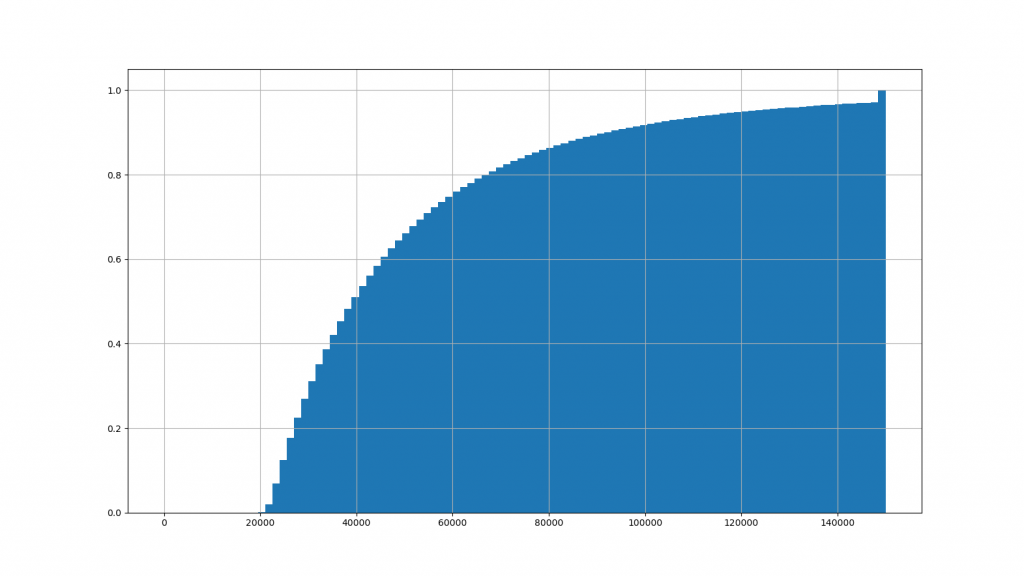

The plot below shows the cumulative density function of Bitcoin’s high price before end of 2021. You can read the chart by taking a price on the x-axis, like $60,000, and then tracing up to the y-axis which is about 75% chance. This means that Bitcoin’s 2021 high price has a 75% chance of being below $60k. The graph truncates at $150,000 (so $150,000 should be read as $150,000 or above).

What the lowest price that Bitcoin will hit in 2021?

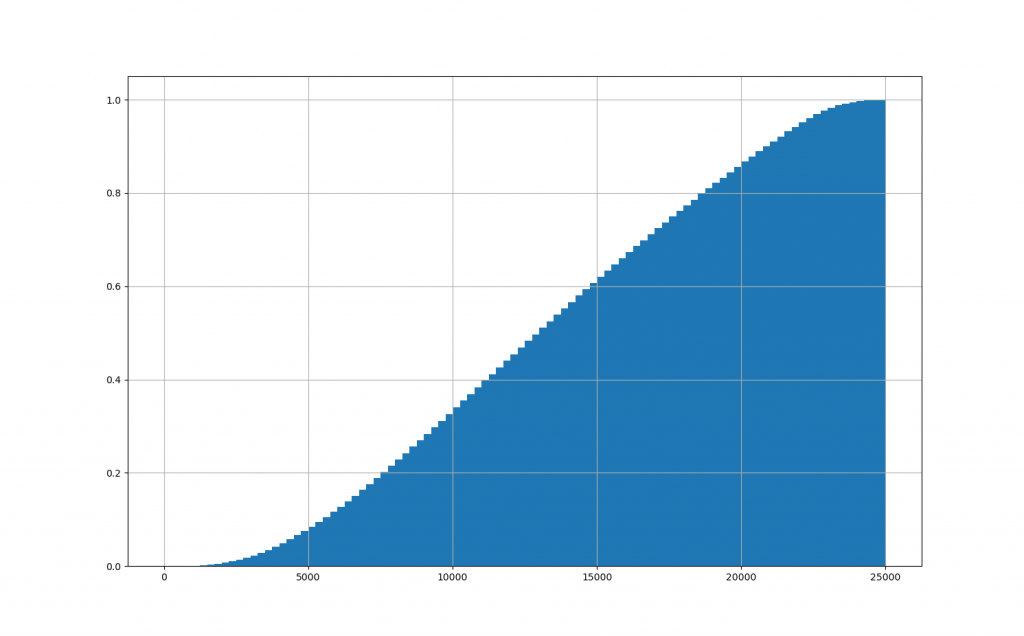

Before you get too optimistic, realize that Bitcoin’s volatility means that the highs can be high, but the lows can be low too. The same exact model above can give us low prices for the year. The median low price is $12,800, which is also approximately the mean low price. In the worst case, the 20%tile low price is $7,500. These low prices emphasize one point: have patience and hold through the low periods — HODL!

Just like before, the below gives the cumulative distribution of low prices in our simulation:

When will Bitcoin hit $40k in 2021?

If you think that $30k is already likely, the next question to ask is, when will Bitcoin hit $40,000? Will Bitcoin hit $40k in 2021? This price level would be double the 2017 and 2020 all time highs, and represent a watershed moment where everyone who has every bought and hold Bitcoin as of today will have doubled their return.

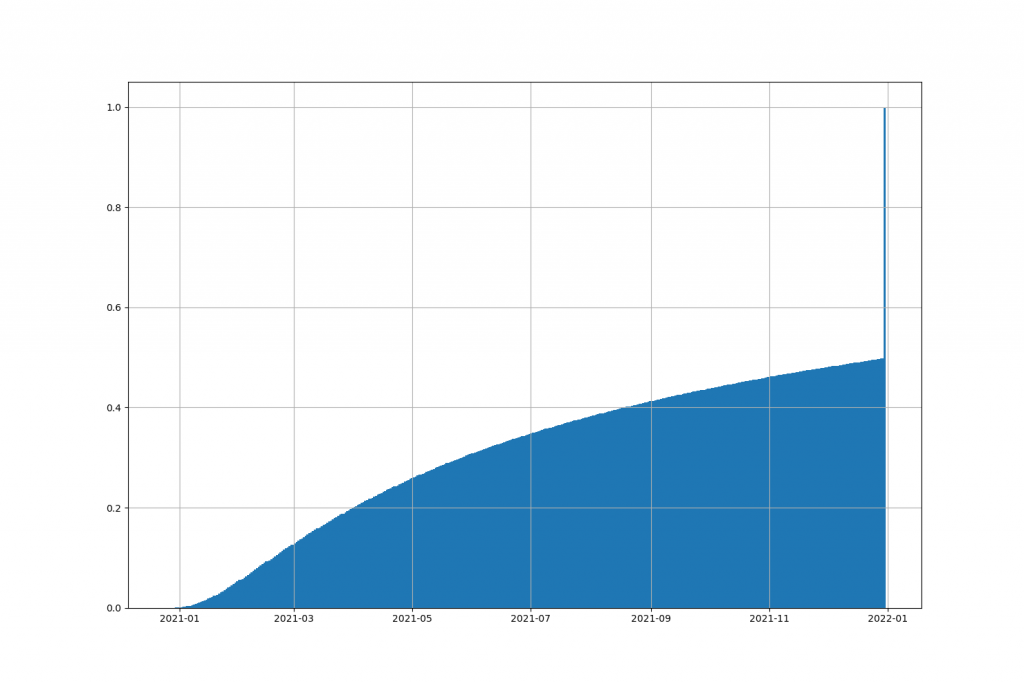

Our analysis shows that there is 50% chance BTC hits $40,000 before the end of 2021. In fact, there is a 34% Bitcoin hits $40k before midyear, (before July 1st 2021) even.

Here is the chart of cumulative probability distribution of when Bitcoin first hits $40k:

Soft Analysis of Bitcoin Price Levels

Soft Analysis of Bitcoin Price Levels

So far, the analysis above has been numerical. We used the gold standard random walk to generate probabilities. This is the same model use by professional option pricers, and can give cold hard numbers. But some discussion of the softer aspects of Bitcoin price make sense.

One important point to note about the $30,000 threshold is that not only is it a large round number, it is only moderately above the 2017 peak. This provides a larger than usual amount of resistance. A number of current Bitcoin holders will have bought into Bitcoin right below this price in 2017. In prospect theory, they are flipping from the loss domain to the gain domain — this makes them much more risk averse due to the principle of loss aversion. This leads to a large amount of selling demand as Bitcoin price first pushes through the range right above $20k.

If you liked this, you might like our similar analysis on when Ethereum will hit $1k and $10K!