Note: This post was written January 7th, 2021 and is good as long as prices remain around today’s levels.

Bitcoin has finally hit $39k as of January 2020! Bitcoin’s next clear threshold is $100k. Will Bitcoin hit $100k in 2021, or beyond that? We use empirical option pricing data to generate a random walk model that gives you hard numerical predictions for when BTC will hit $100k (or the next step, $50k).

Which model to use for Bitcoin price movement?

When Bitcoin hits a certain price depends on your model.

The industry gold standard numerical predictions is a random walk model that pulls volatility information from actual trade data. This is the model we use, pulling implied volatility from Deribit.

The random walk model is appropriate even if you’re a Bitcoin bull or bear. You can believe that in the long run, Bitcoin will go up. But if you believe that short-term, fluctuations in Bitcoin price every minute are mostly uncorrelated, then you believe in the random walk model. This model also generates cold hard numbers to inform your investments, versus vague pronunciations of “resistance” or “profit taking”.

When will Bitcoin hit $30,000 in 2021?

Running 1,000,000 ensembles in using our gold standard model, we project that Bitcoin will at least touch $100,000 with 36% chance on or before December 31st, 2021.

But 2021 is a long time. When exactly will Bitcoin actually hit $100k?

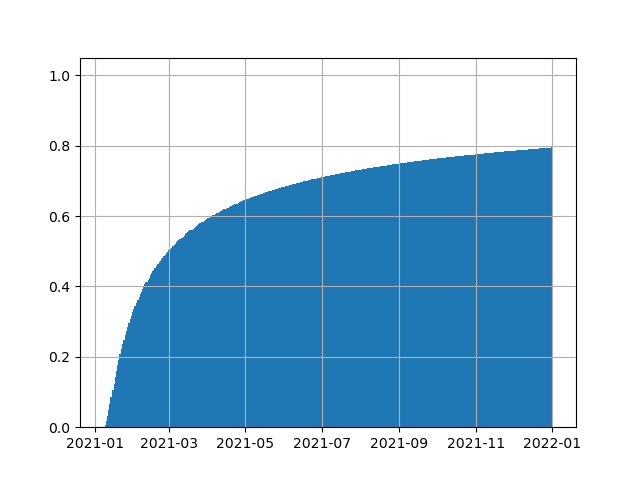

The below chart gives the cumulative distribution of when Bitcoin will hit $100k. To read the chart, first take a date like 2021-07-01 (which lines up to the “2021-07” tick below). Find the date on the x-axis, and then go up to the y-axis, where you get .20. This means that Bitcoin will hit $100k before 2021-07 with 20% chance.

You can see that that there is a 32% chance of hitting $100k before November 2021, and a 3% chance of hitting $30k before March 2021.

What the highest price that Bitcoin will hit in 2021?

From our same model, we can calculate the highest price that Bitcoin will ever hit before the end of 2021. We calculate that Bitcoin’s median high price in 2021 will be $80,000, and Bitcoin’s average high price will be $97K.

Why is the average high price greater than the median high price? Because of positive skew: in the best ensembles from our simulation, Bitcoin’s high price is much higher than average.

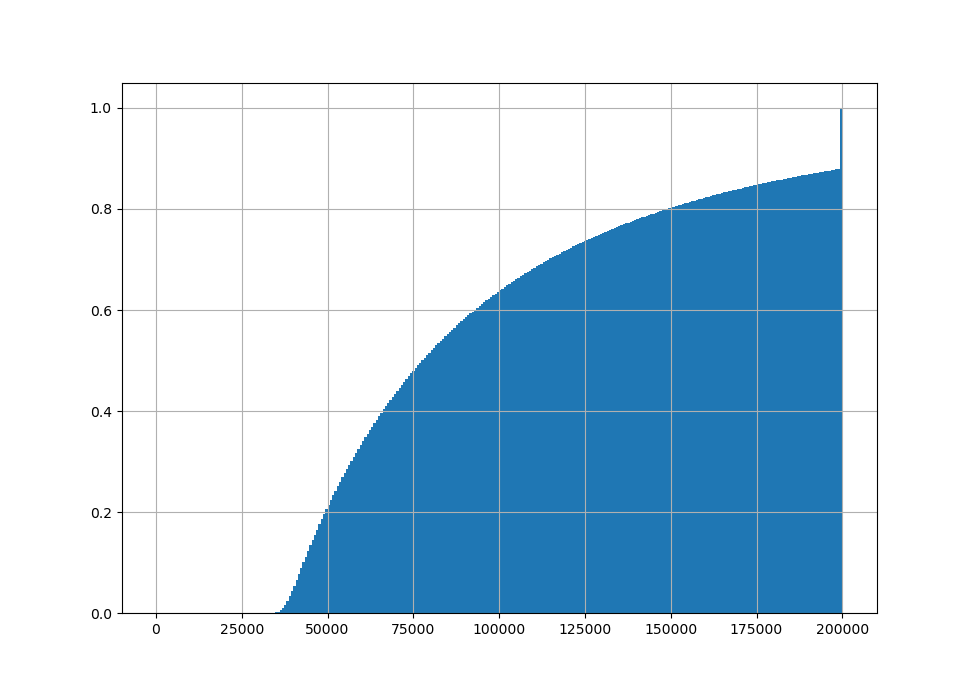

The plot below shows the cumulative density function of Bitcoin’s high price before end of 2021. You can read the chart by taking a price on the x-axis, like $75,000, and then tracing up to the y-axis which is about 48% chance. This means that Bitcoin’s 2021 high price has a 48% chance of being below $75k. The graph truncates at $200,000 (so $200,000 should be read as $200,000 or above).

What the lowest price that Bitcoin will hit in 2021?

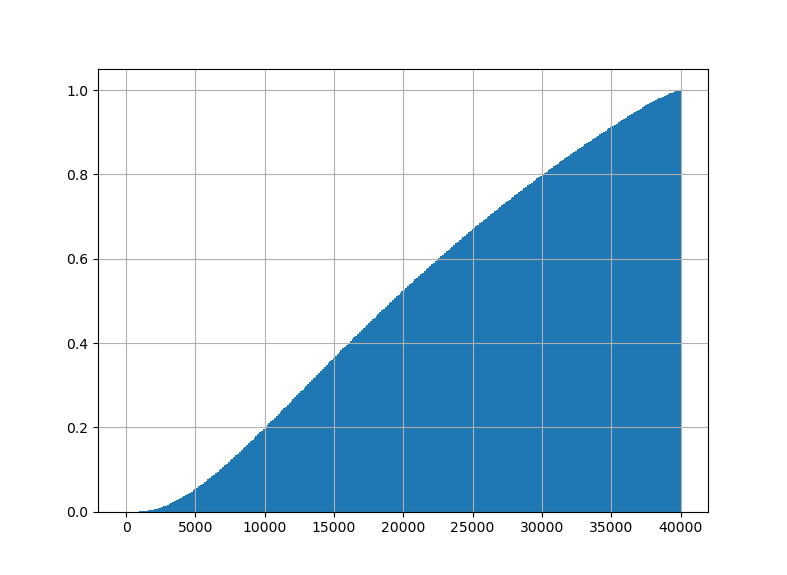

Before you get too optimistic, realize that Bitcoin’s volatility means that the highs can be high, but the lows can be low too. The same exact model above can give us low prices for the year. The median low price is $18,000, which is also approximately the mean low price. In the worst case, the 20%tile low price is $10,000. These low prices emphasize one point: have patience and hold through the low periods — HODL!

Just like before, the below gives the cumulative distribution of low prices in our simulation:

When will Bitcoin hit $50k in 2021?

If you think that $100k is too far away, then the next question to ask is, when will Bitcoin hit $50,000? Will Bitcoin hit $50k in 2021? This price level would be 2.5x the 2017 highs, and represent a watershed moment where everyone who has every bought and hold Bitcoin as of the 2017 high will have 2.5x their return.

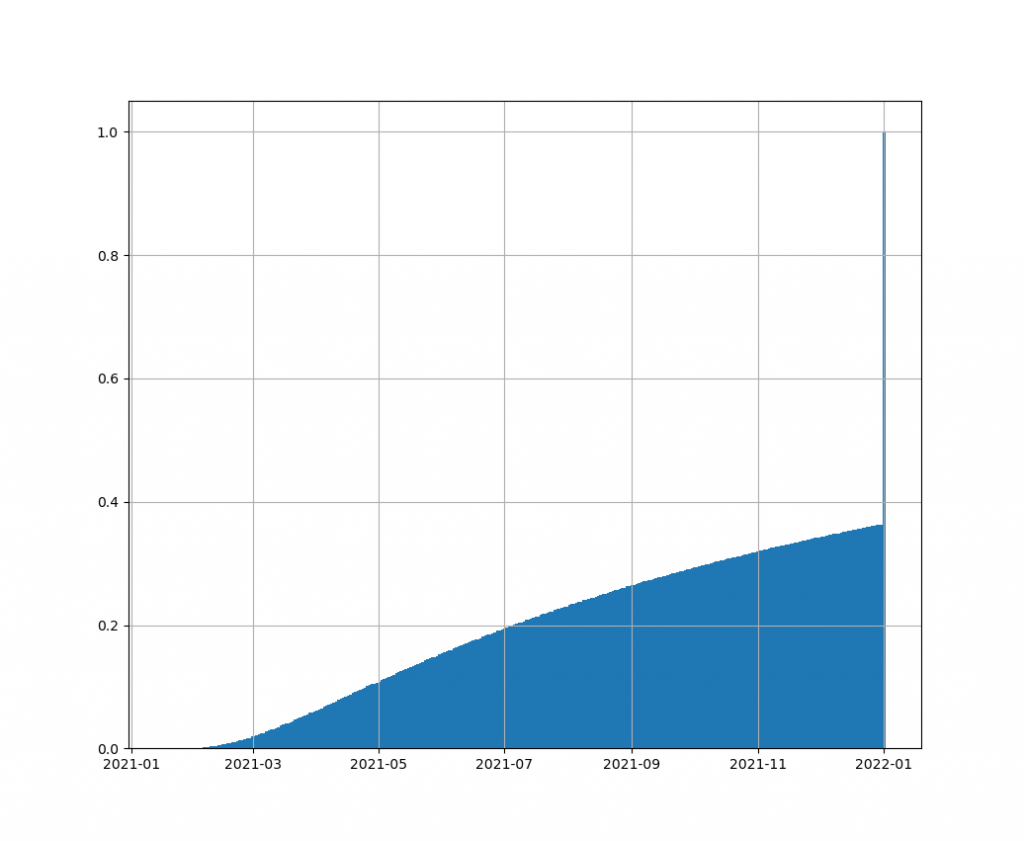

Our analysis shows that there is 80% chance BTC hits $50,000 before the end of 2021. In fact, there is a 70% Bitcoin hits $50k before midyear, (before July 1st 2021) even.

Here is the chart of cumulative probability distribution of when Bitcoin first hits $50k:

Soft Analysis of Bitcoin Price Levels

So far, the analysis above has been numerical. We used the gold standard random walk to generate probabilities. This is the same model use by professional option pricers, and can give cold hard numbers. But some discussion of the softer aspects of Bitcoin price make sense.

One important point to note about the $100,000 threshold is that it’s a large round number. This provides a larger than usual amount of resistance

If you liked this, you might like our similar analysis on when Ethereum will hit $10K!

Check out our new token. It tracks the S&P 500 in a decentralized way on the blockchain. Want $100 of the token for free? Check out our offer here.