What are Maker’s DAI Liquidations?

The MakerDAO (or just Maker) system soft pegs the value of the DAI token to the USD dollar. Maker ensures the value of the DAI token with the collateral system. DAI’s value relies on vaults that contain more than enough collateral, so if collateral values fall, a Maker DAI liquidation occurs. MCD stands for Multi-Collateral DAI, so the collateral can be many types of assets, like ETH or USDC.

How can the Maker system ensure there is enough collateral when the value of that collateral falls? For example, if there is 1 ETH at $500 backing $250 of DAI, everything is fine. But what happens when the value of ETH starts falling to $100, like on March 12th, 2020? Maker’s DAI liquidation aims to soak up DAI as collateral prices fall. This ensures each DAI is still backed by collateral.

In this article, we explain how the MCD liquidation system works in theory.

Note that this article covers the most current MCD (Multi-Collateral DAI) liquidation system active in Maker after November 2019. Articles you read about DAI liquidation that are undated or before November 2019 may talk about SAI, PETH, Wrapped ETH. These articles refer to an older system that is no longer the mainstream Maker system.

How do MCD Dai Liquidations work?

The Maker system sets a margin requirement for each collateral in the DAI system. For example, ETH has historically had a 150% margin requirement. This means you need $600 of ETH in a vault (CDP) in order for that vault to issue 400 DAI. Liquidations kick in generally only when collateral values fall. If you own a vault, you only need to track collateral prices to prevent a liquidation.

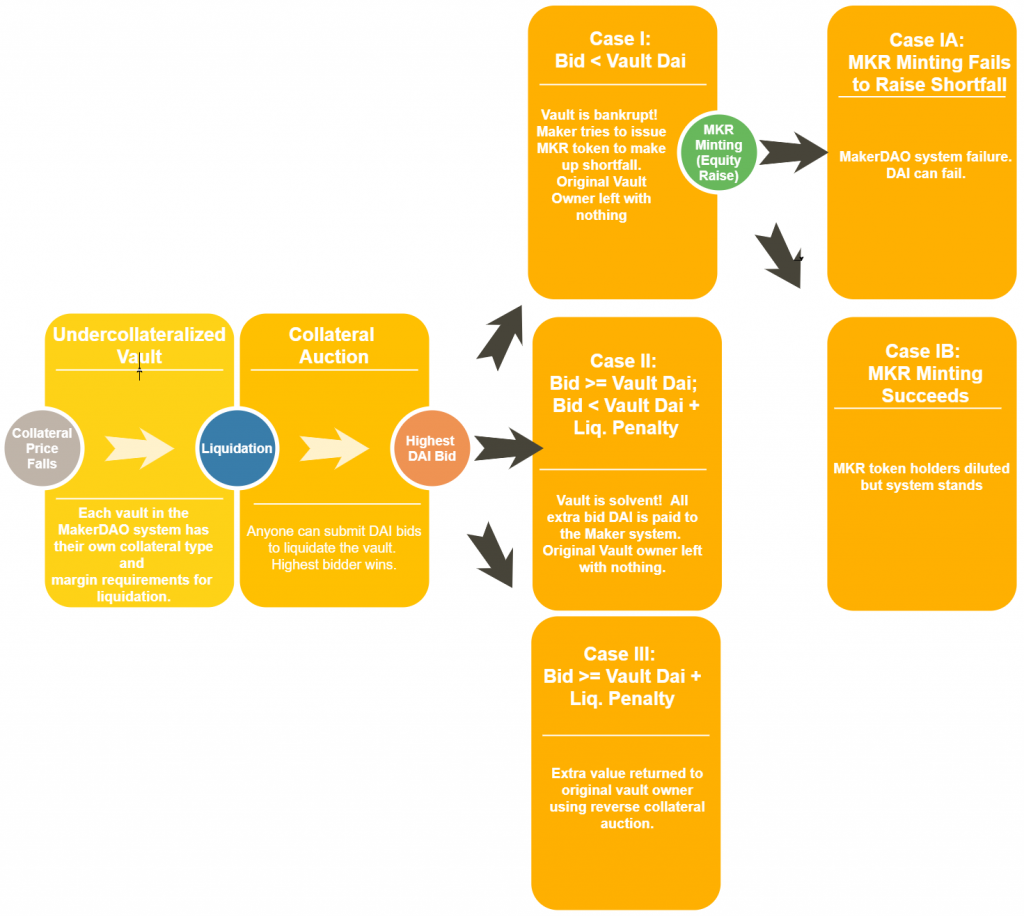

- When a vault’s collateral falls below that vault’s margin limit, a liquidation occurs.

- The first stage of Maker’s liquidation process is the collateral auction. Anyone can submit DAI in this auction to make a claim for the value of the vault. It is this submission of DAI that destroys DAI in the Maker ecosystem and keeps the enter Maker system solvent. What happens next depends on the max amount of DAI submitted:

Case I: The amount of DAI submitted is less than the DAI issued by the vault.

This is a bad case of the world. We have a bankrupt vault (synonymously CDP or collateralized debt position) .

Why would users not bid enough DAI to the collateral auction?

If no one bids enough DAI to cover the collateral, this could mean the vault is bankrupt. This can happen if the price of collateral jumps downwards, as has happened to ETH many times in the past.

This case also occurs if the governor of a collateral governor decides to freeze MakerDAO’s assets. For example, Coinbase Inc. a US company, controls USDC. Maker accepts USDC as a collateral. If Coinbase freezes Maker’s USDC, either voluntarily or due to a court order, the USDC in Maker becomes effectively worthless. No one will want to bid DAI for these frozen USDC.

Finally, another reason users won’t submit enough DAI to cover the amount issued is auction mechanism failure. This happened on March 12th, 2020 (more on that in a later series).

What happens when a vault in Maker is bankrupt?

There are two possible outcomes. The slightly bad case occurs if MakerDAO can issue enough MKR tokens to pay back the remaining DAI owed by a vault [1]. In terms of traditional corporate finance, you can see MKR as equity in a company and DAI as debt. The Maker company is issuing equity to raise money to pay down debt. This is only slightly bad because it retains the integrity of DAI (keeps it at $1), and the only cost is dilution of MKR holders.

The very bad case occurs if MakerDAO doesn’t have enough MKR issuance capacity. This could readily occur. Seeing MKR as equity and DAI as debt, if the Maker system is even moderately underwater, why issue equity to protect debt-holders when equity-holders can instead declare system bankruptcy and start with a blank slate? This would happen if Maker governance decided to abandon the current system to start a fork, or if someone else forked Maker.

Inability to issue MKR in also a self-fulfilling prophecy. If the ecosystem seems Maker as broken due to a wave of vault bankruptcies, the market cap of MKR will fall, meaning Maker can’t issue enough MKR to pay for the system’s DAI debt.

Thankfully, while the slightly bad version of Case I for Maker (MKR) has happened in the past, the very bad case for Maker has never happened before.

Case II: The amount of DAI submitted is more than the DAI issued by the vault, but less than the liquidation penalty

This is a much better case of the world. In this case, users have submitted DAI equal to or greater than the amount owed by the vault. This means the vault is solvent and not bankrupt! The vault then absorbs all the DAI it created. But that’s not the end of the story!

The Maker system has a liquidation penalty. Because liquidations are risky for the entire Maker system (see Case I) above, Maker creates the right negative incentive for vault owners to stay margin compliant. This negative incentive is in the form of a liquidation penalty, historically set at 10%.

In this case of the world, the collateral auction doesn’t raise enough money to cover beyond the liquidation penalty, so all the extra DAI submitted in the collateral auction goes to paying the liquidation penalty.

The liquidation penalty is paid to the Maker system, and effectively to the holders of the MKR token. This provides both a source of income for MKR token holders, as well as compensation for the risk MKR token holders are taking in Case I of the world.

Note however that if you were designing a new system, it would be much more important to have a liquidation penalty at all (to incentivize vault holders to put in more collateral) than it would be have this fee paid to MKR token holders. In fact, this fee could be paid to the liquidators to incentivize faster liquidation, or to some other party. (For example, the ItoVault system has a simple robust liquidation process that rewards fast liquidators.)

Case III: The amount of DAI submitted for the vault would be more than the DAI issued by the vault and the liquidation penalty combined.

This case of the world is even better! Just like Case II, the vault is solvent, so all the DAI it issued is returned, and the system integrity is maintained. The full liquidation penalty is paid to the Maker system, compensating them for the risk in Case I. What happens if bidders want to bid even more DAI, because the vault collateral is worth more?

In this case of the world, economically, the original vault owner receives the the extra value. If enough value in the vault remains, the original owner is always the residual (i.e. marginal or final) claimant.

Technically, Maker implements this not with bidders actually bidding extra DAI, but instead by bidding less collateral to confiscate. This means that after any bidder in the first collateral auction has bid the full DAI issuance plus liquidation penalty, a reverse collateral auction starts.

In a reverse collateral auction, bidders then bid decreasing amounts of collateral to confiscate, until there is a winning bidder that wants the least amount of collateral. Maker returns this difference in collateral to the original vault owner.

There is no critical reason for this complex system: a simple collateral auction that remits extra DAI to vault owners could work, as well as even simpler systems.

To summarize:

If the value of collateral in a vault falls below a threshold compared to the DAI issued, the vault becomes undercollateralized. This starts the liquidation process where a collateral auction occurs. Case I: If the auction raises less DAI than the vault has issued, the vault is bankrupt. Maker mints MKR token to dilute MKR holders and fill the gap. If enough users buy the minted MKR, the system is stable. If not, the MKR system breaks and DAI could lose its peg. Case II: if the auction raises enough DAI to cover the amount issued by the vault, the first marginal amount goes to paying a liquidation penalty (fee) to the Maker system. Case III: If the vault has enough value to cover both the DAI issued AND the full liquidation penalty, Maker returns the extra value to the original vault owner.

[1] To be technically more complete, in Case I, if there are bankrupt vaults and there is still extra DAI in the surplus pool, MakerDAO will use this extra DAI to plug the hole first before needing to issue MKR tokens. The approximate surplus DAI as of December 2020 is about 4 million, which would allow for that much underwater vaults. To complete the corporate finance analogy, the surplus DAI pool can be seen as the company’s holdings of cash, preventing the entire system from going bankrupt.