This guide shows you the key steps to generate DAI with Maker. It highlights 2 key mistakes to avoid, which have cost past DAI creators millions of dollars in losses.

Mistake #1: Generating DAI when You Should be Buying DAI

Should you generating DAI with Maker, versus getting DAI in other ways? We list bad reasons to use MakerDAO to generate DAI:

- Stability: You want to hold DAI because it is more stable than ETH or BTC.

- Savings / Yield enhancement over USD: You think the US Dollar has too low of a yield in banks. By using DAI, you hope for a stable but higher returns investing in places like AAVE, Compound, etc.

- Inflation Avoidance with USD exposure. Your country restricts USD usage, and you want DAI to avoid your local currency inflation in a way that is low volatility (versus buying gold, or Bitcoin directly).

For all of the above applications, you should instead be directly buying DAI through a marketplace like Coinbase or Uniswap. On Uniswap, you can directly convert your ETH to DAI with no remaining ETH exposure.

You can use your ETH to get DAI in one of two very different ways. 1) Use Maker to generate DAI from ETH or 2) Buy DAI directly. If you’re not sure, just want DAI, and the rest of this section is confusing (2) is likely the right solution.

Why Generating DAI with Maker has risks versus directly buying DAI

What’s wrong with generating DAI with Maker for the above use cases? You do get DAI, but you’re also left with a CDP (collateralized debt position, i.e. vault). The CDP is a vault that locks up your ETH until you pay back the DAI you generated. This CDP’s value is volatile; it’s a leveraged ETH position. The CDP also must be maintained: you have to check regularly (e.g. every day) to see ETH hasn’t spiked down in volume. If it has, you must immediately send more ETH to your CDP, or our CDP will be lost (liquidated with a penalty).

You should only generate DAI if you’re fine with CDP monitoring or actively seeking CDP volatility. This brings us to two good reasons to use maker to generate DAI:

- Leveraged ETH (or other collateral, like WBTC) bets. This is empirically one of the top reasons people use Maker to generate DAI. They can then sell the DAI for more ETH (e.g. on Uniswap). Then they lock this ETH up in their CDP and generate more DAI. This allows you to lever up your ETH bet. If leveraged ETH, along with it’s liquidation risk, is what you’re looking for, this is the main good reason to use Maker to generate DAI. This usage explains more than 48% of the current usage of Maker (48% is the fraction of Maker collateral comprised of ETH and WBTC).

- DAI is overpriced so there is arbitrage. If DAI is trading at say $1.10, you can use USDC collateral to generate a vault at thin collateralization rates to short DAI, and buy back DAI when its price is closer to $1.00. This use case makes up about 40% of current Maker usage.

Mistake #2: Not Maintaining Your CDP Vault

After you generate a CDP vault, you may be tempted to leave it alone and check back monthly or even yearly. That would be a huge mistake. ETH is volatile, and has fallen by 40% within a day multiple times. Unless you’re massively overcollateralized (think 300%), not checking back daily will expose you to liquidation risk. Users have lost millions of dollars worth of ETH in their vault many times before due to not checking in regularly.

How regularly should you be monitoring your vault? Given a -40% negative jump potential for ETH and the 150% collateralization requirement, unless you have >300% collateralization for your vault, you should be monitoring daily or mre frequently.

The easiest way to do this is to set up an alert for ETH prices. Calculate what ETH level would cause your vault to go into liquidation, and then set up an alert for when ETH drops half as much. You can use Yahoo Finance or other smart phone apps. But automated, redundant monitoring is best, because then you don’t have to manually remember to check in every hour.

How to Actually Generate DAI from Maker

The actual method to generate DAI from Maker is easy:

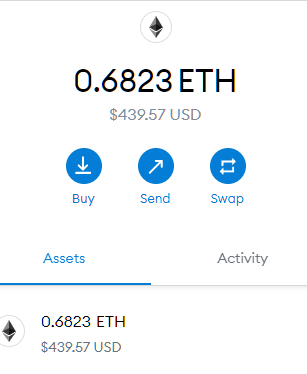

- Start with a web3 wallet (like MetaMask) with ETH (or another collateral) in it:

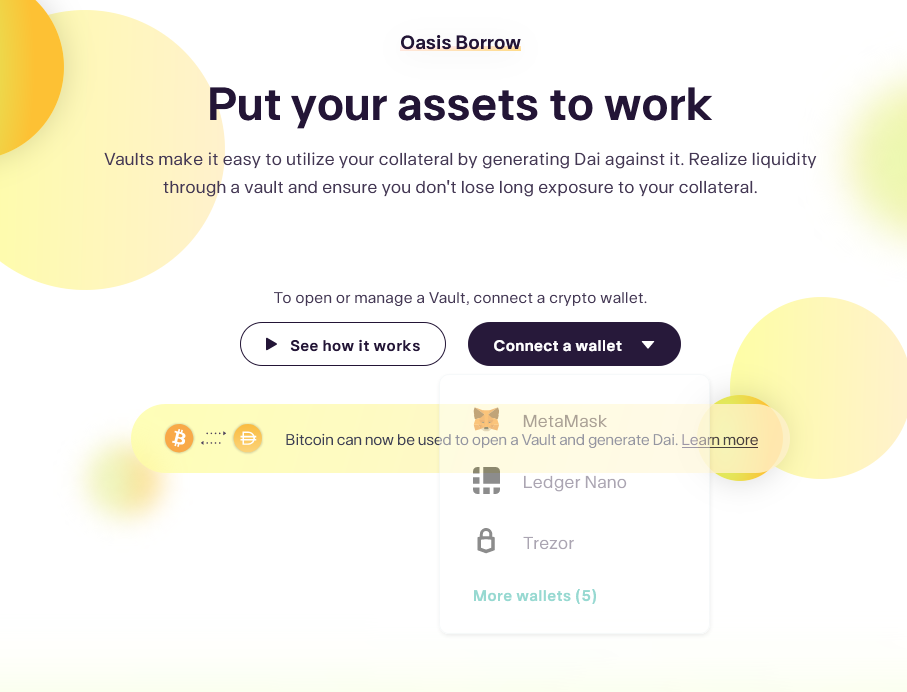

- Navigate to Oasis and connect your wallet:

3. Hit Get Started:

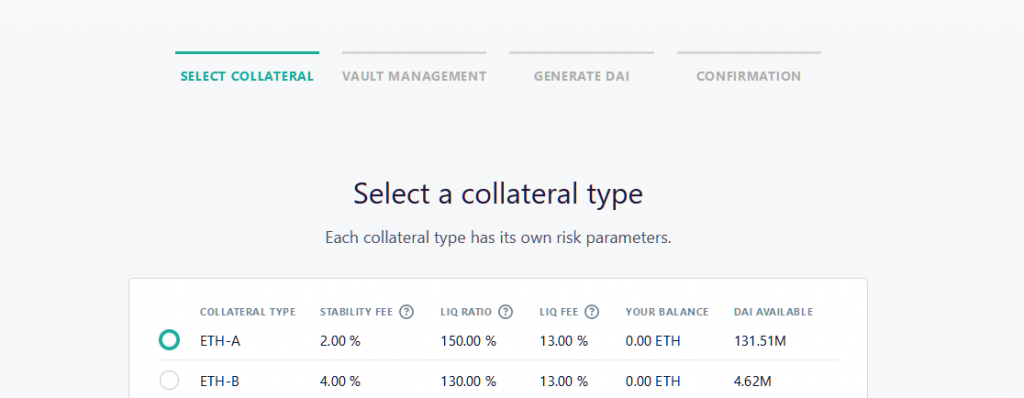

4. Choose the collateral you will put in. Note the stability fee. Note that if an A-version and B-version are both available, you generally want the A-version because you’ll pay a lower stability fee. (The B-version is for situations of distress that is too detailed for this article).

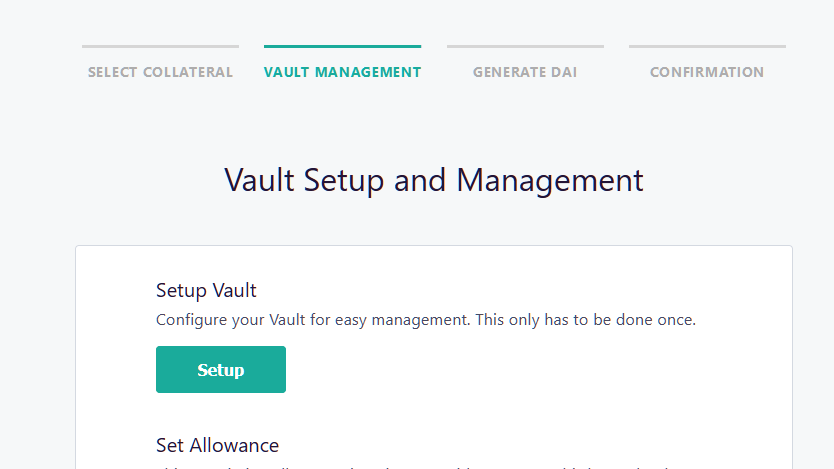

5. Hit “Setup”. Note this costs substantial gas, but is a one-time cost.

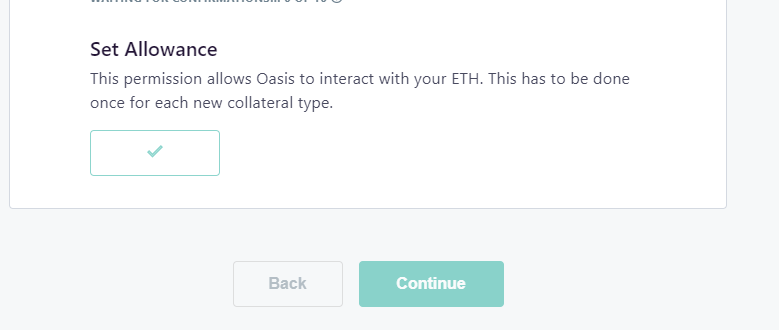

6. Hit “Set Allowance”.

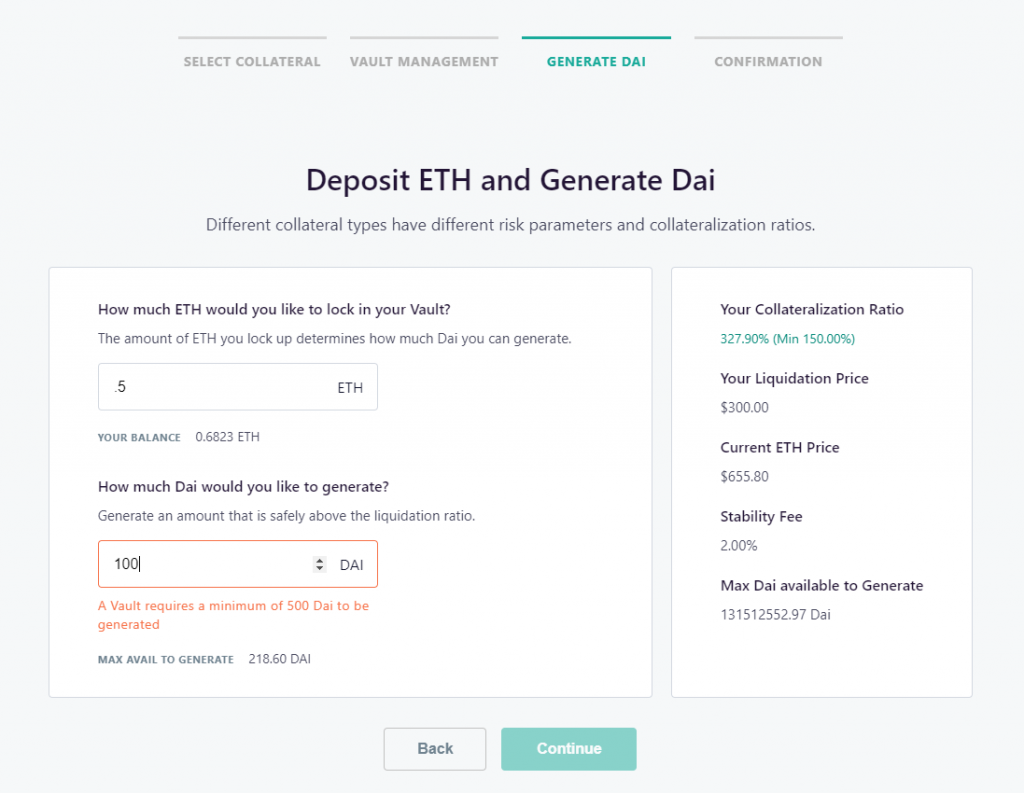

7. Set number of ETH to deposit, and DAI to generate. Note you must generate a minimum of 500 DAI (set to cover overhead costs of a vault). You must put in enough ETH to overcollateralize this debt. Practically speaking, with these limits, you shouldn’t generate DAI unless you have over $1000 worth of ETH.

8. Hit okay on the confirmation page:

9. Watch your DAI show up in Metamask.

If your web3 wallet doesn’t include DAI as a default coin, you can usually find an “add by address” button and paste in the following:

0x6b175474e89094c44da98b954eedeac495271d0f

That is the official address of the DAI ERC-20 token.

10. That’s it! You’ve successfully generated DAI using Maker. Don’t forget to go back to the Oasis page regularly to maintain your vault!